External spend can typically run from 30 to 70 percent of a company’s total expenditure, depending on the industry. It’s a staggering amount – but it’s also an opportunity. This level of expenditure can be used to transform a business by not only reducing costs, but by achieving competitive advantage and driving profitable growth.

Unfortunately, procurement is still seen as a back-office function in too many organisations. Because of this, businesses don’t know enough about where the money is going and – more importantly – why.

A comprehensive Commercial Business Review goes beyond a procurement maturity model; it uncovers the effectiveness of processes and frameworks that govern all aspects of a company, and it determines whether workers know what they’re doing and why they’re doing it.

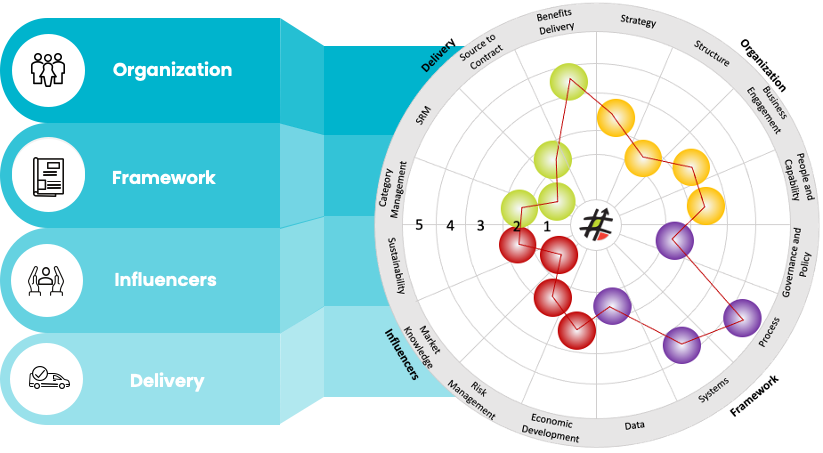

Comprara’s Commercial Business Review delves into 16 core components of an organisation and evaluate it on each one. At the end, you’ll know where you sit within your industry, where the gaps are and how to realise your ambitions.

The 16 Components of a Commercial Business Review

Strategy

There are three main questions to this component:

- What are your overall business objectives?

- What are your individual procurement category strategies?

- Is your answer to the second question helping you achieve your answer to the first question?

Many businesses have a good macro view of their organisation; they know, overall, what they want to achieve. But things happening at the micro level, such as category strategies, aren’t working towards this vision. We need to get the two married up.

We also look at the influence procurement has in the organisation. Does it have a seat on the board, or is it represented by the finance function (as is often the case)? These two departments approach things in vastly different ways, so is this really serving your wider commercial goals?

We want to know what you think of procurement: back-office function or strategy driver?

Structure

A single procurement deal is a complex process (or, at least, it should be). Before parties even arrive at the negotiation table, a lot of prep work has to be done: engaging stakeholders, speaking to suppliers, requesting and reviewing documents and information regarding the good or service to be procured.

There’s a lot of hours involved in a single deal. If an organisation spends $500 million annually on buying things and has 150 deals in place, but there’s only two people in the procurement department, it’s simply impossible that the best contracts are being secured (and managed). The structure of your procurement department matters.

People & Capability

Ebbinghaus’s Forgetting Curve demonstrates that, without reinforcement, new information is forgotten very quickly. There’s no point to engaging your staff in training seminars if they don’t then use these new skills often in their day-to-day tasks.

They can come away from a seminar on negotiating with really goods tools and techniques, but if their next negotiation in the real world isn’t until next month, those new tricks are forgotten. When this happens, people fall back on what they know, on what they think they’re good at. The same old mistakes are then repeated.

You need the right training coupled with the right reinforcement.

Teamwork is also put under the microscope: how do your people work together? Do they share important information? Do they even know who might need this information? Do they work well with stakeholders and suppliers?

Governance & Policy

Nearly everything that happens within a commercial enterprise needs to be consistent. To achieve this, the right policies and guidance materials need to be in place and accessible.

This is about employees only purchasing the things they’re allowed to, and raising the purchase order the same way every time. These policies need to be clear and digestible; it should be easy for new employees to work out how things are done in your organisation. By the same token, when an employee leaves, they shouldn’t be taking with them pertinent knowledge that is then lost to the business.

Process

In a typical procurement review, we’d look at the effectiveness of your end-to-end procurement process, including contract management and sourcing. Because this is a commercial review, though, we take it wider.

For instance, is procurement and marketing working in line with one another? If marketing decides to run a promotion on a particular product, has procurement been made aware? They need time to source extra stock in anticipation of a spike in demand. Alternatively, procurement, as buyers, know margins better than anyone; do they know of an alternative product that is more appropriate for promotion?

Are departments talking to each other? Do they understand the impact their actions have on the wider business? Do they know when to consult with others?

Systems

Software and technology can be transformative for every organisation – if used wisely. We look at what systems you have in place and what technological roadmap you have for the future. Do you constantly review your analytics? Are you aware of what’s available on the market and how it might benefit you? What is your plan to get better at managing data?

Contract Management Systems are especially important. If procurement identifies, say, $1,000,000 worth of savings, we estimate that 60% will drop off if the supplier isn’t managed well. All businesses need to be actively managing their contracts with the help of up-to-date software solutions.

Data

Two things are important here: the quality of your data sources and the insights you derive.

Where is your data coming from? What are its limitations? And – importantly – what do you do with it? Dashboards are great, and they can highlight trends and anomalies. But deriving meaningful insights, actionable insights, is still a human’s job. Does your company possess the knowledge and expertise to do this?

And are you sharing it with other departments? Too many organisations don’t realise what knowledge they have as a whole because teams aren’t communicating and sharing the information.

Economic Development

We assess the quality of your category strategies. Do you know who you are buying from? Do you know why? Do you recognise the exposure or market power certain suppliers bring?

Right now, there’s a profound timber shortage in Australia. Exacerbating this is the fact that three timber mills were recently lost in bushfires and there are currently no plans to replace them. If you’re a timber supplier, what is your plan to combat this? Have you thought about investing in a timber mill? Have you thought about buying from overseas, which will be more expensive but will guarantee your supply?

It’s only an example, but it illustrates the things organisations need to be thinking about – and planning for.

Risk management

Good risk management involves looking into the future. What policy framework do you have in place that not only helps you identify risk, but manage it? And what is the outcome for the organisation? Can you report on it?

We’re talking about risk regarding people, products and processes. For instance, do you know who is making what you’re buying? Is it a workforce employed under fair and reasonable contracts? Or is it child labour?

We examine whether you have the ability to answer these questions, how quickly you can identify risk and what remedial action is put in place.

Market knowledge

How much time and effort goes into keeping up with the markets? Are you simply looking at IBISWorld? Are you reading market reports?

Secondly, what are you doing with this information? It needs to be shared among stakeholders, and it needs to be used to make pre-emptive decisions.

If you can see that prices are going to rise in products that you buy, it might be wise to start incrementally raising your own prices early so customers aren’t hit with a sudden hike, otherwise they’ll go to the competition and you’ll lose market share.

Can you see it coming and can you do something about it?

Sustainability

Lots of organisations have an interest in sustainability, but few implement meaningful strategy that will see their vision realised.

Firstly, you need to know the current environmental and social impact of your supply chain. Then you need to identify what it is you hope to achieve, and how. Do you have the ability to monitor and report on sustainability outcomes?

Getting adequate visibility of supply chains is one of the trickiest tasks for the modern business. Committing to sustainability measures and then having poor practices exposed within one of your vendors has never been more damaging. And ignorance is no longer an excuse.

What frameworks do you have in place?

Category management

This one comes down to three main questions:

- Why are you buying it?

- How are you buying it?

- What will the impact on the business be?

We also want to know the extent to which stakeholders are engaged, and whether these processes are done in a consistent manner.

There are tools and techniques out there that have been developed for decades to specifically make category management easier and more effective. Are you aware of them and, if so, are you using them appropriately?

SRM

This isn’t just about having an SRM framework in place; it’s about having one that is easily digestible for anyone who needs to use it. There’s no point having one if it’s a door-stopper and no one can be bothered to read it. It needs to be practical.

What about strategies? Do you tier your suppliers? The Kraljic Model is a tried-and-true method of sorting your suppliers by complexity. You should be devoting more time and energy towards those suppliers who are strategic, and less towards those who are simply transactional.

You have limited hours and, most likely, not enough personnel: time management is key in supplier relationship management.

Source to contract

This is about market approach. Can you articulate the business need, and what processes are you conducting to ensure a proper market approach? It may sound obvious, but organisations need to understand how to evaluate the product or service, and the supplier. What is the framework you’ve developed to do this?

Benefits delivery

It’s important that staff have the ability to articulate the benefits to the C-suite and any other stakeholders. What can be done to maximise the chance of gaining these benefits? Or, in other words, have you identified the risks and put in place processes to minimise the chance of them occurring?

Get to know your organisation

A thorough commercial business review goes beyond procurement; it looks into everything that procurement affects, and everything that affects procurement. As you can see, that’s the entire organisation.

Once conducted, you’ll have a better understanding than ever before of where your money is being spent and why. You’ll know which processes and frameworks are fit for purpose, which ones need adjustment, and which need to be established.

Get in touch with the team at Comprara today, and get to know your organisation.