Every year, thousands of small businesses in Australia struggle with cash flow challenges, not because they’re unprofitable, but because they’re waiting to get paid. Late payments cost small businesses more than just money – they impact jobs, growth, and innovation across our economy. For many small business owners, it’s the difference between thriving and merely surviving.

This is why the Payment Times Reporting Scheme (PTRS) matters.

For procurement professionals, this isn’t just another compliance requirement. It’s an opportunity to demonstrate how procurement can drive positive change in our supply chains. When we ensure timely payments to our small business suppliers, we’re not just following regulations – we’re building stronger, more resilient supply chains and supporting the backbone of Australia’s economy.

Introduced in January 2021 and enhanced with new amendments effective July 2024, the PTRS brings unprecedented transparency to payment practices. But beyond the reporting obligations lies a more fundamental question: How can procurement teams leverage this framework to create lasting value for both their organisations and their suppliers?

This guide explores not just the ‘what’ and ‘how’ of PTRS compliance, but more importantly, the ‘why’ – why timely payments matter, why procurement’s role is crucial, and why getting this right can transform your supplier relationships and organisational reputation.

Please note that the information provided here reflects current understanding and interpretations but may change over time. We encourage you to review the official sources directly to ensure you have the most up-to-date and accurate information.

Quick links:

Procurement and the Payment Times Reporting Scheme

Procurement’s fingerprints are all over PTRS success – and here’s why.

When you’re negotiating those all-important payment terms in contracts, you need to nail the PTRS requirements from the get-go.

And let’s face it, how well your company pays directly impacts whether suppliers see you as a partner or a problem. Here’s the kicker – get labeled as a ‘slow payer’ and watch how quickly suppliers think twice about bidding on your next tender.

Your operational procurement team is right in the thick of it too, making sure invoices flow smoothly through approval workflows that meet PTRS timelines.

But here’s where it gets interesting – smart procurement teams are turning payment performance data into a strategic advantage, using it to make better sourcing decisions and identify their most reliable suppliers. Ask us how!

Understanding the Payment Times Reporting Scheme

The PTRS is a regulatory framework established to improve payment practices for small businesses in Australia. It mandates that large businesses and some government entities report their payment terms and actual payment times to small business suppliers, defined as those with an annual turnover of less than AUD 10 million.

Objectives of the Scheme

- Promote Transparency: By making payment information publicly available, the scheme empowers small businesses to make informed decisions about their potential customers.

- Improve Payment Times: Public reporting incentivises large businesses to adopt timely payment practices, thereby enhancing their reputation and avoiding negative publicity.

- Support Small Businesses: Timely payments improve the cash flow of small businesses, fostering financial stability, growth, and the broader economic benefits of increased employment and wages.

When Were Changes Made?

January 1, 2021: Original PTRS implementation

July 1, 2024: New amendments take effect

September 7, 2024: Major changes to the laws behind the Payment Times Reporting. The reforms to overhaul the scheme are now in effect.

Key Reporting Requirements

Who Must Report?

Entities required to report under the PTRS include:

- Large Businesses: Entities carrying on an enterprise in Australia with consolidated accounting revenue (not taxable income) exceeding AUD 100 million

- Corporate Groups:

- Entities with an annual income over AUD 10 million that are part of a controlling corporation with a combined income over AUD 100 million

- Groups must assess their reporting obligation based on consolidated accounting revenue

- Government Enterprises: Commonwealth corporate entities and Commonwealth companies meeting the income threshold

What Must Be Reported?

Every six months, reporting entities must submit detailed reports that include:

- Standard Payment Terms: The contractual terms offered to small business suppliers.

- Actual Payment Times: Data on how promptly invoices are paid, categorised into time frames (e.g., within 20 days, 21-30 days, etc.).

- Use of Supply Chain Finance: Disclosure of any arrangements that may affect payment times, such as reverse factoring.

Submission and Publication

Reports are submitted via the Payment Times Reporting Portal and published on the Payment Times Reports Register, which is publicly accessible. This transparency allows stakeholders to assess and compare the payment practices of large businesses.

Why Should Procurement Care About PTRS?

While payment practices primarily fall under Finance’s responsibility, Procurement plays several crucial roles that impact PTRS compliance and organisational value:

Strategic Value:

Let me share something interesting about the numbers – each day you extend payment terms adds about 0.27% of spend value to your working capital. That’s real money that directly impacts your organisation’s cash conversion cycle. But here’s the tricky part – you need to balance these working capital benefits against maintaining healthy supplier relationships. It’s not just about the numbers; it’s about finding that sweet spot.

Operational Impact:

Your contract negotiations need to nail those PTRS requirements while keeping suppliers happy. And let’s face it – your payment performance can make or break supplier relationships. Here’s the kicker: get labeled as a ‘slow payer’ and watch how quickly suppliers think twice about offering their best terms or even bidding on your next tender.

Process Integration:

This is where it all comes together. Your operational procurement team needs to keep those invoices flowing smoothly through PTRS-compliant approval workflows. Smart teams are turning payment performance data into a strategic advantage in sourcing decisions. And here’s the real challenge – balancing your Days Payable Outstanding (DPO) objectives with PTRS compliance.

DPO measures how long your company takes to pay its bills, and traditionally, Finance wants this number higher to hold onto cash longer. But here’s the tension – while Finance might push for 90-day payment terms to optimise working capital, PTRS is pushing for faster payments to small businesses. It’s a case of competing goals: maximising cash flow on one side and maintaining strong supplier relationships and PTRS compliance on the other. When you get this balance right, both your working capital and your supplier relationships benefit.

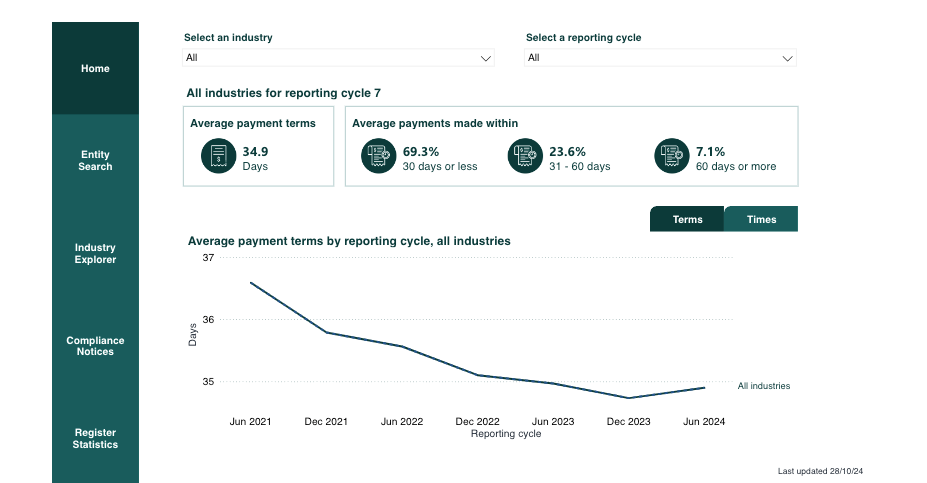

The Payment Times Reports Register: A Tool for Transparency

Link: https://register.paymenttimes.gov.au/dashboard.html

The Payment Times Reports Register serves as a critical component of the PTRS by providing:

- Detailed information on payment terms and actual payment times

- Access to historical payment performance data

- Ability to track changes in payment practices over time

- Tools for small businesses to make informed decisions about potential business partners

What it empowers small businesses to do:

- Facilitating Informed Decisions: Small businesses can evaluate the payment reliability of potential large business partners.

- Encouraging Best Practices: Public visibility of payment performance motivates large businesses to improve payment times to maintain a positive reputation.

- Enabling Comparative Analysis: Stakeholders can compare payment practices across entities and industries, fostering a culture of accountability.

Recent Amendments

In June 2024, Parliament passed amendments to the Payment Times Reporting Act 2020, significantly updating the Payment Times Reporting Scheme (PTRS). These revisions clarify the scheme’s purpose, streamline reporting, lessen regulatory burdens, and intensify both incentives for prompt payments and consequences for slow-payers among large businesses.

Key Updates

- The new regulations will first apply to the six-month reporting period beginning on or after 1 July 2024.

- Groups must now determine their reporting obligation based on consolidated accounting revenue, using the $100 million threshold.

- Reporting is now required on a consolidated basis across all subsidiaries, replacing the prior entity-by-entity reporting approach.

- A new mandate allows the slowest 20% of small business payers within each industry category, based on the past 12 months of payment statistics, to be identified as ‘slow small business payers’ on their website, financial statements, and other public documentation. This adds reputational pressure, elevating the scheme’s significance among company leadership and Boards.

- A public registry will list all ‘fast small business payers’ with payment times of 20 days or fewer, recognising top performers.

- Entities can apply for an exemption from reporting if, for instance, they have a one-time revenue surge due to an asset sale, pushing their consolidated revenue above $100 million.

- The Regulator has gained additional roles, including the authority to conduct research and publish analyses on payment practices, as well as enhanced compliance and enforcement capabilities.

- Reporting entities now have an automatic extension for their first report under the new rules: any report originally due before 30 June 2025 is automatically extended to this date.

These updates aim to simplify compliance, promote prompt payments, and provide both accountability and rewards for large businesses’ payment practices.

Implications for Procurement Professionals

These amendments have several implications for procurement:

- Contract Reviews: Existing contracts may need revision to align payment terms with PTRS requirements

- Supplier Communication: Small businesses (under $10M turnover) need clear communication about payment processes and timelines

- Bid Evaluation: Consider payment processing efficiency when designing tender requirements and evaluating responses

- System Integration: Ensure P2P systems support compliant payment practices

- Performance Metrics: Include payment compliance in supplier performance management frameworks

Your strategic procurement team needs to take a hard look at those standard payment terms lurking in tender documents and contract templates – they might need a refresh. Meanwhile, category managers, you’ve got a crucial task: mapping out which suppliers in your categories fall into that small business bracket (remember, that’s under $10M turnover) and really understanding how payment terms impact them. For our operational procurement team, it’s all about streamlining those invoice processing workflows. And here’s something that often gets overlooked: your procurement systems need to clearly flag small business suppliers in the master data.

PTRS Impact on Procurement Activities

Sourcing and Tendering:

- Include payment terms compliance in tender documentation

- Consider payment processing capabilities in supplier evaluation

- Flag small business status in supplier registration processes

- Align standard payment terms with PTRS requirements

- Include small business identification in contract templates

- Monitor payment performance in contract reviews

Supplier Relationship Management:

- Include payment performance in supplier scorecards

- Address payment issues in supplier review meetings

- Support small business suppliers with clear payment processes

Systems and Processes:

- Configure P2P systems to flag small business suppliers

- Support data collection for PTRS reporting

Spend Analytics:

- Monitor payment performance metrics for small business suppliers

- Track average payment times across different categories and business units

- Generate reports showing:

- Percentage of invoices paid within target timeframes

- Average payment times for small business vs. other suppliers

- Payment performance trends over time

- Identification of bottlenecks in payment processes

- Create dashboards to:

- Visualise payment performance against PTRS requirements

- Alert procurement teams to potential compliance issues

- Monitor progress toward ‘fast payer’ status

- Identify opportunities for payment process improvement

- Support proactive management by:

- Predicting potential payment delays before they occur

- Identifying categories or suppliers at risk of late payments

- Providing early warning of potential ‘slow payer’ designation risk

Leveraging Spend Analytics for Success with Comprara

At Comprara, we’ve developed a spend analytics solution to assist businesses in efficiently complying with the Payment Times Reporting Scheme.

The solution provides visual representations of extensive data sets in an easy-to-read format. The payment overview offers a snapshot of your payment data and its alignment with the requirements of the Payment Times Reporting Scheme. It highlights key metrics such as payment terms, values, and frequencies, particularly focusing on small business suppliers.

With interactive visualisation features, you can delve into payment performance details, drilling down to specific transactions. The data can be filtered by individual reporting entities to provide targeted insights. Additionally, a vendor analysis dashboard delivers deeper understanding of payment performance at both the vendor and reporting entity levels.

Our specialist team can help determine your business’s ranking among small business payers based on the past 12 months of payment data. We identify the necessary improvements to mitigate the risk of being classified as a ‘slow small business payer.’ Through analytics, we assist in pinpointing which payments and vendors to focus on for the most significant enhancement in your payment times ranking.

Discover how Comprara’s spend analytics solution can streamline your payment reporting and improve your supplier relationships. Contact us today to learn more.

Building a Sustainable Future

The Payment Times Reporting Scheme marks an important evolution in Australian business practices. For procurement leaders, success means partnering with Finance and other stakeholders to:

- Build stronger, more resilient supply chains

- Support small business growth and innovation

- Demonstrate leadership in sustainable business practices

- Create lasting value through improved supplier relationships

As the scheme continues to evolve, procurement teams have an opportunity to showcase their strategic value by helping their organisations not just comply with PTRS requirements but excel in supporting a healthy and vibrant business ecosystem.

Think about it: When we pay small businesses on time, we’re not just ticking a compliance box – we’re investing in Australia’s economic fabric. Every prompt payment strengthens a supply chain, fuels innovation, and builds trust. This isn’t just about following rules; it’s about leading by example and showing that the way we pay reflects who we are as an organisation.

As the scheme evolves, ask yourself: Do you want to be known as the team that merely complied with PTRS, or the one that helped transform Australian business practices? Because in the end, this isn’t about payment terms – it’s about the kind of business ecosystem we want to create for the future.

Frequently Asked Questions on Payment Times Reporting Scheme

1. What is the Payment Times Reporting Scheme?

The scheme requires large businesses and some government enterprises to report every 6 months on their payment terms and practices for their small business suppliers to promote transparency and improve payment times124.

2. Who must report under the Payment Times Reporting Scheme?

Reporting entities include large businesses and government enterprises with an annual income over $100 million, or entities with an income over $10 million that are part of a controlling corporation with a combined income over $100 million234.

3. What is the income threshold for reporting entities?

The income threshold is over $100 million in total annual income for the entity or its controlling corporation. For entities within a group, the threshold is $10 million if the group’s combined income exceeds $100 million234.

4. Are charities exempt from reporting?

Yes, entities registered under the Australian Charities and Not-for-profits Commission Act 2012 are exempt from the reporting requirements

5. How often must reports be submitted?

Reports must be submitted every 6 months, covering the first and second halves of the reporting entity’s income year

6. What information must be included in the reports?

Reports must include information on standard payment terms, actual payment times, and the use of supply chain finance arrangements

7. How are reports submitted?

Reports are submitted through the Payment Times Reporting Portal

8. Where are the reports published?

The reports are published on the Payment Times Reports Register, which is publicly accessible

9. What is the purpose of the Payment Times Reports Register?

The register makes payment information publicly available to help small businesses make informed decisions and to encourage large businesses to improve their payment times

10. Does the scheme set mandatory payment times?

No, the scheme does not mandate specific payment times but aims to promote transparency and encourage timely payments

11. How does the scheme benefit small businesses?

The scheme helps small businesses by providing transparency on payment practices, enabling them to make informed decisions about potential customers and manage their cash flow better

12. What are the consequences of non-compliance?

Non-compliant entities may face civil penalties, including fines and public disclosure of non-compliance. The maximum penalty is 60 penalty units for individuals or 300 penalty units for a body corporate

13. What powers does the Payment Times Reporting Regulator have?

The Regulator can monitor compliance, investigate suspected non-compliance, require compliance audits, impose infringement notices, and apply to a court for civil penalty orders

14. Can reports be revised after submission?

Yes, reporting entities can apply to revise their submitted reports through the reporting portal, providing the revision date and description of the changes

15. How do reporting entities identify their small business suppliers?

Reporting entities use the Small Business Identification (SBI) tool to identify and report on their small business suppliers

16. What is the Small Business Identification (SBI) tool?

The SBI tool is a resource provided to help reporting entities identify and report on their small business suppliers

17. What is the reporting window for submitting reports?

Reporting entities have a 3-month window after the end of each reporting period to submit their payment times reports

18. Can entities volunteer to report if they are not required to?

Yes, constitutionally-covered entities that do not meet the income threshold can volunteer to submit a report

19. How can small businesses access the payment times reports?

Small businesses can access the reports through the Payment Times Reports Register, which is available as a downloadable Excel file and an interactive dashboard

20. What is the role of the Payment Times Reporting Regulator?

The Regulator administers the scheme, monitors compliance, investigates non-compliance, and enforces the reporting requirements under the Payment Times Reporting Act 2020124.

21. When did the Payment Times Reporting Scheme commence?

The scheme commenced on 1 January 2021, with a 12-month transition period before full compliance and enforcement powers took effect

22. What are the key objectives of the Payment Times Reporting Scheme?

The scheme aims to make information about large businesses’ payment performance publicly available and to create incentives for improved payment times and practices

23. How does the scheme impact the reputation of large businesses?

Public transparency on payment practices can incentivise large businesses to improve their payment times to avoid reputational damage.

24. Can the Regulator ‘name and shame’ non-compliant entities?

Yes, the Regulator can publish details of non-compliance on the register or elsewhere, which can impact the reputation of non-compliant entities

25. What guidance is available for reporting entities?

The Regulator’s website provides guidance materials to help reporting entities understand the scheme, reporting requirements, and how to access and report through the portal